October 29 — Yi He’s trajectory defies convention. Her path from village poverty to Bloomberg’s “crypto’s most powerful woman” built the infrastructure connecting 280 million users to digital assets and a $125 trillion trading empire,

By June 2025, Binance commanded 41% of global crypto spot trading. The world’s largest crypto exchange now processes 217 million daily trades. These metrics reflect Yi He’s user-first philosophy, transforming a 2017 startup into cryptocurrency’s dominant platform.

Early Life in a Rural Village

Yi He was born in 1986 in remote Sichuan province to teacher parents. Poverty defined her childhood—kerosene lamps provided lighting, money stayed scarce. Her father died when she was nine.

By sixteen, she worked outside supermarkets promoting soft drinks. These early hardships taught resilience that would prove essential in crypto’s volatile market.

Despite financial constraints, education remained a priority. She completed university and transitioned into television hosting for travel programs, including “Beautiful Destinations” on Travel Satellite TV. But entertainment wasn’t her endgame. She networked with Beijing entrepreneurs, absorbing discussions about investments and emerging technologies.

Bitcoin entered her world in 2013.

Co-Founding the World’s Largest Crypto Exchange

Yi He joined OKCoin in March 2014 as Vice President, handling brand building and marketing operations. Results came fast.

Yi He built marketing campaigns that gave OKCoin 60% of China’s Bitcoin trading by 2015. She met Changpeng Zhao around this time. CZ was a Chinese-Canadian programmer who knew how to build trading systems. Yi He thought he’d be perfect for OKCoin and talked him into joining as CTO. The two made a solid team—her marketing skills, his tech knowledge.

Things went sour in 2015. Both Yi He and CZ had disagreements with OKCoin’s leadership and direction which ended with them both leaving. Their exit set the stage for something bigger.

In July 2017, CZ proposed co-founding a new global exchange. Yi He agreed, joining as co-founder and CMO in August. Her first task: rewriting Binance’s whitepaper.

Her marketing proved decisive. Referral programs, AMA sessions, and her established reputation in Chinese crypto communities drove explosive user growth. Binance became the world’s largest exchange by trading volume within six months.

Yi He implemented an unusual operational philosophy. Every new employee, regardless of role, spent the initial weeks in customer support. She personally monitored Telegram channels and social media, responding to user issues around the clock.

The Road to $125 Trillion

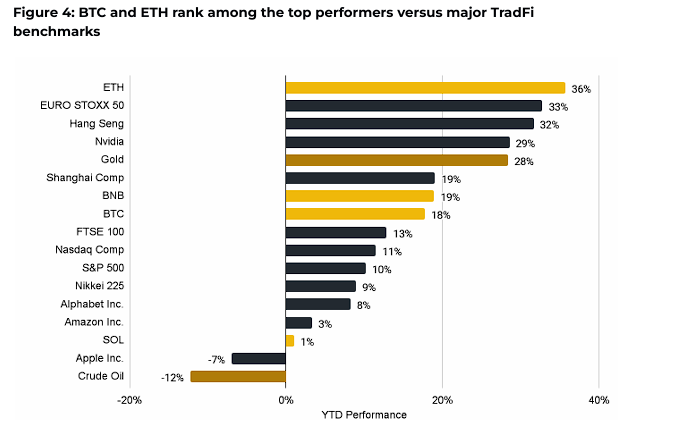

Current data shows the scale of the infrastructure Yi He helped build. A recent Binance Research report shows BTC and ETH rank among the top performers versus traditional finance benchmarks. ETH leads major assets with 36% year-to-date returns while BTC posted 18% gains, both crushing the S&P 500’s 10% performance.

This market strength flows through Binance’s platform metrics. The exchange has processed $125 trillion in total transactions since inception. Daily averages exceed 217 million spot and futures trades. June 2025 data shows Binance maintaining 41% of global spot market share—nearly four times its closest competitor.

Yi recently commented on the trajectory of crypto’s integration with traditional financial ecosystems, “Crypto isn’t just the future of finance – it’s already reshaping the system, one day at a time.”

In 2022, Yi He took control of Binance Labs, now operating as YZi Labs. The venture arm manages over $10 billion in assets across 200+ blockchain projects. Her investment approach prioritizes sustainable infrastructure over speculative tokens.

Operational results validate this strategy. Binance Earn has generated $50 billion in user savings since launch. Binance Pay processed $230 billion across 300 million transactions, saving users $1.75 billion in remittance fees between 2022-2024.

Navigating Regulatory Storms

Yi He’s leadership faced its biggest test during Binance’s US regulatory settlement. In November 2023, the company paid $4.3 billion in penalties while CZ pleaded guilty to anti-money laundering violations and served four months in prison.

The crisis could have destroyed most firms. Instead, Binance maintained market leadership. Working with new CEO Richard Teng, a former Singapore regulator, Yi He helped implement compliance frameworks while preserving competitive advantages.

Data from this transition demonstrates institutional confidence. Binance’s institutional user base grew 97% during 2024. Corporate treasury adoption accelerated, with public companies now holding 1.07 million BTC across 174 firms. Ethereum corporate holdings rose 88.3% recently to 4.36 million ETH.

The Architect of Crypto’s Future

Yi He focuses on building practical crypto infrastructure rather than trading speculation. She sees cryptocurrency and traditional finance merging within five to ten years. Stablecoins and blockchain settlement systems will drive this shift.

Recent data supports this thesis. Total stablecoin supply rose 35% to $277.8 billion. Regulatory clarity from legislation like the GENIUS Act provides frameworks for institutional adoption. This creates a foundation for mainstream payment applications extending beyond trading.

Corporate balance sheet adoption represents sticky, long-term demand rather than speculation. This pattern aligns with Yi He’s view of cryptocurrency becoming essential financial infrastructure.

From a village in Sichuan to building a $125 trillion trading platform, Yi He’s story breaks typical patterns. Her journey from poverty to co-founding Binance has connected millions of people to digital assets and serves as an inspiration for many.

This industry announcement article is for informational and educational purposes only and does not constitute financial or investment advice.