Uncertainty continues to define today’s financial landscape. A weak US labor market, ongoing Treasury selloffs, and persistent inflation concerns have made long-term debt less attractive to investors. Even the prospect of Federal Reserve rate cuts has not restored confidence.

Since 2020, this climate of policy and market instability has pushed both institutional and retail players to seek alternatives, and one area gaining attention is the evolution of stablecoins.

The Evolution of Stablecoins

First-generation stablecoins like USDT and USDC proved their usefulness for payments, remittances, and storing value on-chain. But their model has limits. Fixed transaction fees can disproportionately impact small transfers. For example, a $1 fee represents 10% of a $10 transfer, and all profits from the system accrue to centralized issuers.

A second wave of stablecoins, sometimes referred to as Stablecoins 2.0, is reshaping that model. Instead of profits being concentrated, returns from circulation are redistributed among users. Governance also shifts: participants can help set parameters such as the “haircut” on collateral (the buffer applied to protect against price drops), protocol fees, and ecosystem decisions.

The result is a shift from “stable money” to “productive money.” A dollar held in a next-generation stablecoin remains protected like cash, but it also becomes active within an ecosystem, potentially earning yield or contributing to governance. In this way, users can maximize the effectiveness of every dollar without sacrificing stability.

Why Liquidity Matters Right Now

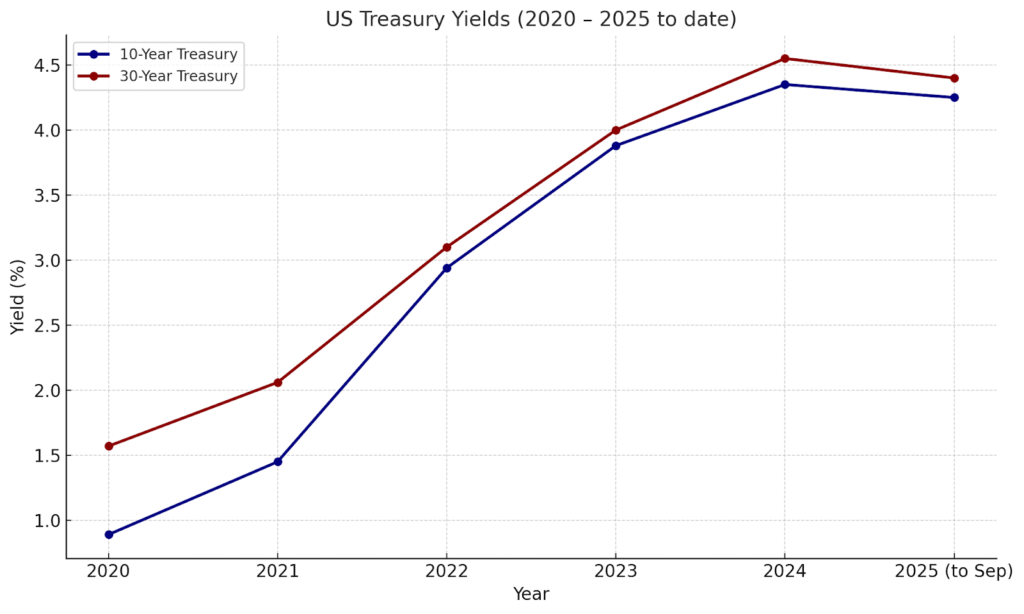

Liquidity is one of the central questions in today’s macro environment. Depressed demand for long-term debt has been fueled by weak US labor data and slowing manufacturing activity. Treasury yields have risen as traders sell off bonds, reflecting concerns about government spending and inflation.

As shown in the chart below, both 10-year and 30-year US Treasury yields have steadily climbed since 2020, peaking in 2024 before slightly easing this year. Although yields remain close to recent highs, the combination of rate volatility and ongoing policy uncertainty suggests traditional debt markets may be losing their appeal.

Even anticipated rate cuts by the Fed are not widely seen as a sufficient remedy. This long stretch of uncertainty has amplified the appeal of tokenized, on-chain assets that provide 24/7 accessibility, global participation, and transparent settlement.

Precedent and Ecosystem Context

The idea of tokenizing traditional financial assets has gained traction in recent years. BlackRock, the world’s largest asset manager, has explored tokenized funds to make conventional instruments blockchain-ready. Ondo Finance has developed tokenized products that give crypto users exposure to assets like US Treasuries without requiring direct access to Wall Street infrastructure.

These initiatives show that institutional investors see value in combining the stability of government bonds with the liquidity and transparency of blockchain. By moving traditionally time-constrained assets on-chain, they create instruments that can be traded globally, around the clock, and without reliance on intermediaries.

This momentum paves the way for projects like STBL, whose stablecoin USST takes tokenized Treasuries a step further by embedding them into a framework designed for everyday use. If tokenized bonds can serve as a base for yield-bearing products, integrating them into stablecoins extends those benefits to payments, storage, and ecosystem participation.

USST’s Liquidity and Risk Mechanisms

USST’s design ties stability to one of the most trusted instruments in global finance: US government bonds. Operating on-chain adds flexibility since liquidity is no longer limited by market hours or geography. Transactions settle instantly, and investors worldwide can participate without layers of traditional banking infrastructure.

To safeguard the system, USST addresses three main risks:

- Market risk: Even Treasuries can fluctuate in value. By combining them with DeFi instruments that often move in the opposite direction, USST creates a natural hedge against volatility.

- Liquidity risk: Stablecoins must be redeemable quickly and at full value. By attracting both crypto-native and traditional investors, and by enabling 24/7 secondary trading, USST aims to strengthen liquidity even during periods of market stress.

- Credit risk: Counterparty defaults are a major source of instability. By using government bonds directly as collateral and avoiding multi-repo structures, USST cuts out intermediaries that can introduce systemic vulnerabilities.

Together, these mechanisms highlight how stablecoins can merge the reliability of traditional assets with the accessibility of decentralized finance.

Implications for the Future of Stablecoins

These developments signal a broader transformation in how stablecoins function.

- For traditional investors: tokenized stablecoins lower the barriers to on-chain exposure while offering diversification anchored in familiar collateral.

- For crypto users: they provide a more resilient base layer for DeFi activity, combining stability with opportunities for yield and governance.

- For the wider market: they act as a bridge between systems that once operated in silos, making global liquidity more transparent and accessible.

Stablecoins began as digital cash equivalents, but they are evolving into multipurpose instruments, a form of money that is not only stable but also integrated into broader financial systems.

In today’s climate of uncertainty, this evolution suggests stablecoins could become an increasingly important link between traditional finance and decentralized markets.

This industry announcement article is for informational and educational purposes only and does not constitute financial or investment advice.