New York, USA (PinionNewswire) —

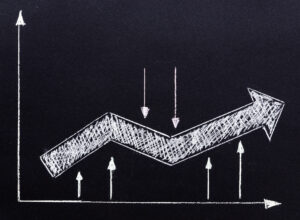

In financial markets, technical indicators, economic data, and trading systems often dominate discussions—but according to TraderGold, the ultimate determinant of performance lies within the trader’s own mindset. Emotional discipline, psychological awareness, and self-management often separate consistent professionals from those trapped in cycles of fear, euphoria, and regret. Understanding how psychology influences trading decisions is essential to long-term profitability and stability.

1. The Hidden Influence of Emotion in Trading

Every trader knows that markets are unpredictable, yet many still fall victim to the same emotional traps. When prices soar, greed urges traders to chase momentum. When prices collapse, fear compels them to exit too soon. These instinctive reactions evolved to protect humans in moments of danger—but in markets, they often cause the opposite: irrational timing, poor entries, and missed opportunities.

TraderGold notes that emotional surges are especially dangerous in leveraged environments. Even small market fluctuations can amplify stress responses, triggering impulsive trades. Traders who allow emotions to dictate decisions often abandon their strategy, overtrade, or take revenge trades after losses—actions that typically worsen outcomes.

Developing emotional neutrality is therefore a competitive advantage. Calm traders analyze probabilities; emotional traders react to noise. The difference, over hundreds of trades, defines who stays profitable.

2. Cognitive Biases That Distort Rational Judgment

Psychological biases—deeply ingrained patterns of thought—regularly influence market behavior without traders realizing it. Among the most common:

- Confirmation bias: Traders seek out data that supports their existing positions, ignoring contradictory signals that could prevent loss.

- Loss aversion: Research shows losses feel twice as painful as equivalent gains feel rewarding. This leads traders to close winning trades too early while letting losing ones run, hoping they’ll recover.

- Recency bias: Recent trends are overweighted, leading to overconfidence during rallies and panic during declines.

- Anchoring bias: Traders fixate on arbitrary reference points—like a prior high or personal break-even price—even when new information renders them irrelevant.

- Overconfidence bias: After a few wins, traders believe their judgment is infallible, increasing position sizes and ignoring risk management.

TraderGold emphasizes that awareness is the first step toward control. Identifying these mental traps allows traders to detach emotion from analysis and act based on evidence, not impulse.

3. Stress, Pressure, and the Physiology of Trading

Market participation activates the same stress responses as physical danger. When positions move rapidly against expectations, the body releases cortisol and adrenaline—narrowing focus and impairing rational thought. Under these conditions, traders are prone to tunnel vision, emotional exhaustion, and decision paralysis.

Professional traders manage this by enforcing strict risk parameters: predefined stop-losses, position limits, and daily loss caps. By reducing uncertainty, they minimize stress and preserve cognitive clarity. TraderGold also advocates incorporating recovery routines—sleep, exercise, and structured downtime—because fatigue often masquerades as poor decision-making. A calm nervous system enables calm analysis.

4. Discipline and the Power of Process

Discipline transforms trading from speculation into strategy. Every successful trader operates within a defined process—entry rules, exit conditions, risk management, and review. The purpose of this structure is not rigidity but protection: it prevents emotional improvisation when volatility spikes.

TraderGold observes that traders who adhere to a tested plan, even during drawdowns, tend to outperform those who constantly shift strategies. This consistency builds statistical reliability and mental stability. Journaling trades—recording not just data but also thoughts and feelings—helps identify recurring psychological patterns, turning experience into insight.

In essence, discipline is emotional armor. It doesn’t eliminate uncertainty, but it prevents panic from rewriting the plan.

5. The Social and Environmental Dimension

Mindset is also influenced by the trading environment. Social media, online forums, and community trading groups can amplify herd behavior and emotional contagion. Seeing others boast of profits often triggers FOMO (fear of missing out), while collective panic magnifies fear during corrections.

TraderGold recommends maintaining a professional mental boundary between observation and imitation. Traders must recognize that every portfolio has unique goals and risk tolerances. What suits one participant may be disastrous for another. Detaching from noise allows for independent judgment and clarity.

6. Building a Resilient Trading Psychology

Long-term success requires cultivating psychological resilience through practical methods:

- Routine reflection: Review trades regularly to assess emotional triggers and decision quality.

- Mindfulness training: Practices such as meditation or controlled breathing reduce stress reactivity and improve focus.

- Goal alignment: Clear, realistic objectives prevent overtrading and impulsive risk-taking.

- Acceptance of uncertainty: No strategy wins 100% of the time. Understanding that losses are part of the process prevents emotional overreaction.

By systematizing these habits, traders can strengthen emotional balance and maintain peak cognitive performance under pressure.

7. TraderGold’s Perspective: Mindset as an Edge

TraderGold believes that psychological mastery is a trader’s ultimate edge. In an era where algorithms and data models dominate execution, human factors remain the decisive variable. Markets may be efficient, but traders are not—and those who recognize and manage their imperfections consistently outperform.

A strong mindset is not about suppressing emotion but integrating it. Awareness, discipline, and adaptability convert volatility from threat into opportunity. As TraderGold concludes, trading success begins not on the screen, but in the mind. Control the mind—and the market follows.