For much of the past two years, SPACs were treated like yesterday’s news, a relic of a speculative bubble that burned too hot. Critics called them a fad, regulators tightened the screws, and investors swore off the structure entirely. But the obituaries were premature. In 2025, the SPAC market is back—smaller, steadier, and far more disciplined.

According to SPACAnalytics and ICR’s 2025 reports, forty-nine new SPAC IPOs priced in the first half of this year, nearly matching the fifty-seven completed in all of 2024. SPACs now represent more than 60 percent of U.S. IPOs and about 42 percent of total IPO proceeds. Nearly 80 percent of this year’s capital has come from repeat, experienced sponsors. The tourists have left and the professionals have stayed.

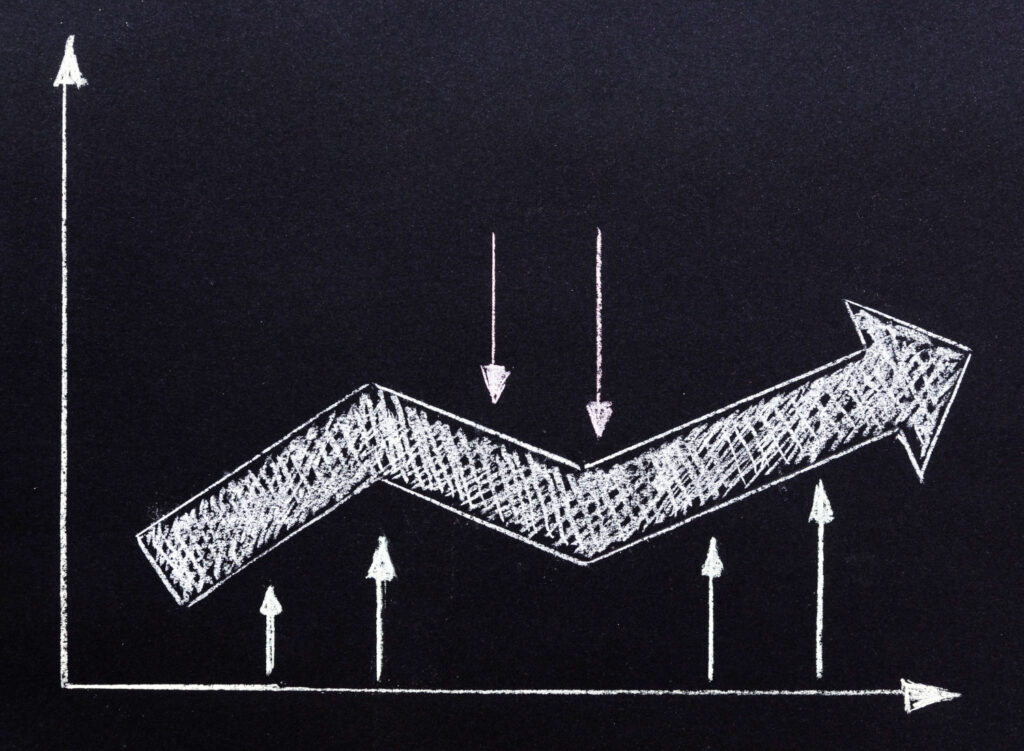

The SPAC market has evolved through four distinct phases. SPAC 1.0 was a niche experiment in the 1990s and early 2000s, used by small sponsors with limited oversight. SPAC 2.0 in the mid-2010s brought institutional capital and stronger governance. SPAC 3.0, the 2020–22 boom, went too far with hundreds of rushed deals and inflated valuations that hurt the market’s credibility. Now we’ve entered SPAC 4.0: fewer transactions, stronger sponsors, and sharper focus. The new generation values transparency, rigorous due diligence, and long-term accountability over quick headlines.

At Blue Water Venture Partners, I’ve seen that evolution firsthand. Our first vehicle, Blue Water Acquisition Corp. I, completed a $50 million IPO in 2020 and later merged with Clarus Therapeutics Holdings, a specialty pharmaceutical company focused on men’s health and rare endocrine disorders. Blue Water II was withdrawn in 2023 amid adverse market conditions, a deliberate choice to preserve investor capital. This year we launched Blue Water Acquisition Corp. III, a $253 million IPO on NASDAQ under the ticker BLUW, targeting healthcare, biotechnology, and artificial-intelligence innovation.

That kind of selectivity defines the new SPAC era. The best sponsors now act less like speculators and more like long-term stewards, performing deep diligence, attracting institutional PIPE investors, and linking compensation to post-merger performance. Regulators have strengthened disclosure standards, and serious sponsors have welcomed the oversight. The result isn’t fewer deals; it’s better ones.

At its core, the SPAC model gives investors earlier access to growth and provides innovative companies a flexible route to the public markets. When done right, it democratizes opportunity without sacrificing accountability. The excesses of the boom years were not a failure of the structure itself but of discipline. Markets correct, and good ideas adapt.

Today’s SPACs are proof of that correction. Investors are insisting on fundamentals, sponsors are earning trust, and founders are focusing on execution. This is not the return of a bubble; it’s the maturation of a tool that is finally being used the way it was intended.

SPACs are back—not as a craze, but as a credible engine for capital formation. And that may be the healthiest comeback Wall Street has seen in years.