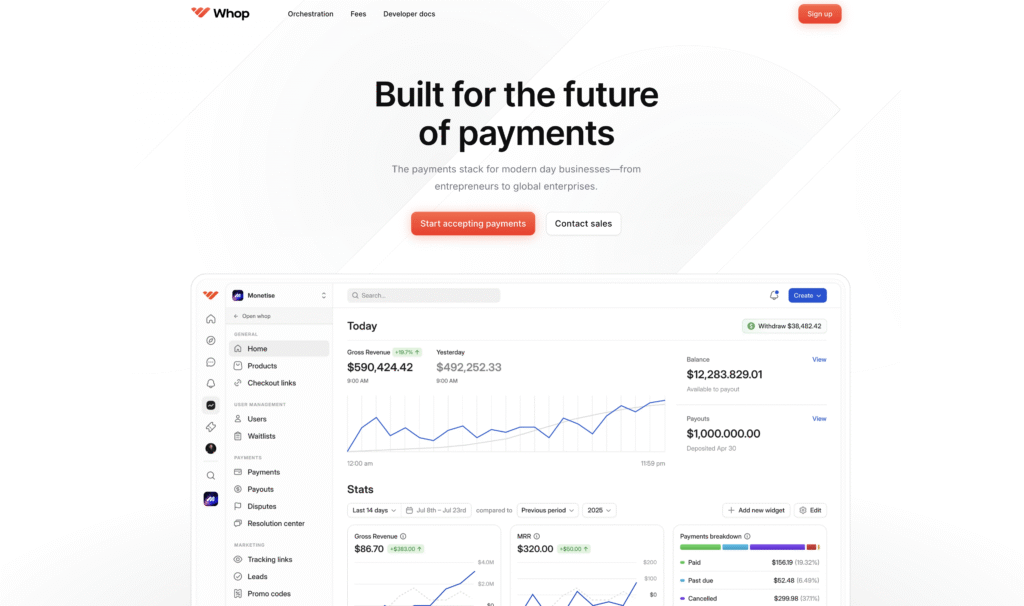

Social commerce platform Whop has launched its own payments infrastructure, officially becoming independent from third-party payment providers.

The move aims to provide digital creators with an alternative that could improve the speed and reliability of payments, while reducing costs. Whop is working to make enterprise-level financial tools available to a wider range of users, from individual sellers to larger businesses.

Reliable payment infrastructure plays an important role in supporting online business growth. Every failed transaction is also a loss of trust, every high fee reduces overall profit, and every limitation on payout methods and currency restricts expansion.

Although advanced payment infrastructure is typically concentrated within large enterprises, Whop Payments extends these capabilities to a wider range of businesses.

Higher Acceptance, Lower Fees, Global Reach

One of the primary features of the rollout is multi-PSP orchestration. This means that each Whop transaction is now automatically routed to the provider most likely to accept it. If a payment fails, it is retried instantly through another processor.

A key detail is that it all happens behind the scenes, without disrupting the customer’s checkout experience. Early testing showed a revenue increase of as much as 10%.

The company announced that it has set its card processing fees to 2.7% + 30¢ per transaction, placing it at a competitive rate compared to common payment processing costs, while still maintaining reliability and performance.

Users are now able to receive funds in nearly every country through local banks, Bitcoin, or stablecoins. For vendors and businesses operating across borders, this aims to make scaling global operations easier.

“When we started, Whop Payments was essentially a Stripe Connect wrapper. Now we’ve built our own infrastructure, from KYC to pay-ins and payouts,” said Hunter Dickinson, Head of Partnerships at Whop.

“That means higher payment acceptance rates, smoother checkouts, and fewer lost sales for our customers.”

Built for Businesses, Not Banks

Feedback has consistently shaped product development. Whop Payments reflects that input, addressing two main concerns.

“Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out,” Hunter explained.

“Our mission is to be the best in the world at solving those problems.”

Unlike traditional processors that only move money from point A to point B, Whop has built payments into a broader ecosystem designed to house all necessary elements of online business.

According to Whop, transactions on the platform are integrated with various creator tools such as: storefronts, memberships, communities, affiliate programs, Content Reward campaigns, analytics, and more.

Those selling on the platform don’t need one solution to process payments, another to host content, and a third to manage subscriptions. It’s all under one roof, making it easier for experienced merchants and new entrepreneurs alike to run ventures on their own terms.

That integration represents a significant difference in approach. The platform integrates payment processing with storefront and subscription tools, reducing the need for multiple third-party services.

With native payments now integrated across the platform, Whop turns what’s often a fragmented stack of software into a single, unified system. The platform has already powered over $1.5B in sales, proving its ability to handle sudden surges in demand and large-scale seller growth.

“Instead of guessing, we ask, listen, and iterate until we deliver the payment solutions that actually move our customers’ businesses forward,” said Hunter.

This marks a turning point for online sellers, big and small. Handling transactions seamlessly within one platform removes friction and gives entrepreneurs the freedom to focus on scaling their models and offers.

This industry announcement article is for informational and educational purposes only and does not constitute financial or investment advice.