Life insurance has been around for hundreds of years, but not enough individuals are covered. Capturing the attention of younger generations means innovating the space, and one company is helping change this reality with flexible and convenient services.

The desire for financial protection isn’t new. It’s a concept that’s been around for longer than you’d think. Its history can be traced back to 100 BC in Ancient Rome when people formed “burial clubs,” stemming from a belief that failing to bury those who passed was a bad omen for the afterlife. So, troops would contribute burial funds to help pay the cost of the funerals and, later, a stipend upon death.

Fast forward to the 1500s. The first written insurance policy was recorded in London, England, by a man named William Gybbon, who purchased a life insurance policy with his friend Richard Martin as the beneficiary. 200 years later, the US saw the emergence of life insurance in the 1700s.

A board of Presbyterian-affiliated officials in Pennsylvania created the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers to protect its ministers and their families, and in 1759, the first American insurance company was organized by Benjamin Franklin: The Presbyterian Ministers’ Fund. Its adoption was slow-moving as many felt life insurance wasn’t worth the investment or viewed it as “poor taste” to place a dollar value on human life, making it an uncomfortable topic. However, by the early 1800s, there were successful life insurance companies in Pennsylvania and beyond, including New York, Maryland, and Massachusetts.

Today, life insurance looks very different than it did 400 years ago. But one overarching aspect remains—the confronting topic of end-of-life matters. Even in the 21st century, more than 100 million Americans are uninsured or underinsured when it comes to life insurance, especially the younger generations of Millenials and Gen Zs.

Rarely does life insurance cross my mind as a priority, especially when many companies in this space don’t necessarily appeal to the needs and wants of younger age groups. With things such as school fees, groceries, car payments, and more taking precedence, typical life insurance is not a practical option for many.

However, more and more companies are paving the way for the insurance industry by shifting to a different approach.

Wysh, an insurance company, operates to empower every person to live life to the fullest, with the confidence of financial protection. They offer life insurance in two ways: Term Life, which is sold directly to customers, and Life Benefit, which allows financial institutions to add free life insurance as a benefit to their existing products.

“When my kids were born, protecting my family was my highest priority. However, the industry’s outdated practices compelled me to make financial protection more reliable and easily accessible,” says Founder Alexander Matjanec.

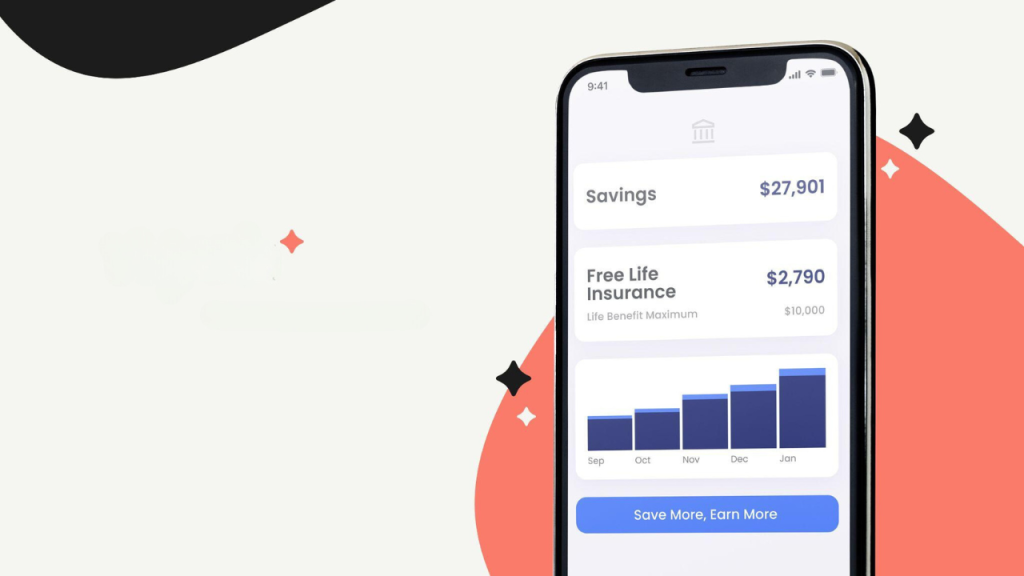

Life Benefit by Wysh is a trailblazing product that embeds up to $20,000 of micro-coverage into the financial ecosystem of its partners in the form of a benefit equal to 1-10% of account holders’ deposits, which sits above their account balance, paid directly to the account upon the account holder’s death. In short, it’s a great way for institutions to attract and retain consumer deposits, especially the younger generations.

People are looking for products and services that enhance their lives without requiring them to do much. Life Benefit does exactly that. The product is redefining the scope and reach of traditional life insurance while giving individuals financial peace of mind during life’s unpredictability, making it easy to feel and stay protected. Life Benefit can be added to checking, savings, or investment accounts, providing automatic coverage based on a percentage of the account balance. It increases customer engagement and stickiness as clients find more reasons to interact with a single, consolidated financial platform for multiple needs — be it banking, investing, or insurance.

From the perspective of a financial institution, Life Benefit not only enhances the value proposition for existing customers but also serves as a compelling feature to attract new clientele.

For individuals seeking a more full-coverage option, Wysh also offers Term Life insurance, which covers a specified number of years. Wysh understands customers don’t fall under a one-size-fits-all approach, and to accommodate their unique needs, they offer a feature called Wysh Builder. This allows customers to choose exactly what they want to protect without additional fees or costs. This service is followed up on by Wysh Granters who step in to make the process even more seamless. Think of them as real-life genies who can make policyholders’ Wyshes a reality. Whether you want to leave behind coverage for medical school, a new condo, or your child’s tuition fees, it’s all possible.

So, when did life insurance become interesting? Right now.

We’re witnessing a transformation that’s turning life insurance from a necessary evil into a dynamic, flexible tool for financial well-being. It’s no longer just about planning for death. It’s about living life with the confidence of financial protection.