When it comes to molding the future of a company, shareholder activism emerges as a pivotal force, as illustrated by a CTO and founder who mediated a co-investment initiative. Alongside insights from seasoned professionals, we also present additional answers that reflect the diverse experiences and strategies employed in the realm of shareholder activism. From the power of transparency in building trust to the role of proactive dialogue in resolving conflicts, join us as we explore the varied dimensions of influencing company direction.

- Mediated Co-Investment Initiative

- Shareholder Influence Feels Limited

- AI Evaluation Aids Shareholder Decisions

- Transparency Builds Shareholder Trust

- Form Alliances for Shareholder Activism

- Focus on Long-Term Shareholder Value

- Diverse Perspectives Enhance Governance

- Proactive Dialogue Resolves Conflicts

Mediated Co-Investment Initiative

One instance that comes to my mind is about private-equity firms that restructured the management of our company. For this shareholder activism, I’ve played a vital role as a mediator from the company to close the deal through a co-investment initiative on a deal-by-deal basis. This step has been revolutionary for our firm and provided it with the direction to grow in the market.

Dhari Alabdulhadi

Dhari Alabdulhadi

CTO and Founder, Ubuy New Zealand

Shareholder Influence Feels Limited

Time for some tough love. This question feels very 1985. The ability for shareholders to actually influence a company’s direction feels as insurmountable as the Egyptian worker who moved the first brick.

Yes, shareholders can still vote on the board of directors and other proxy votes. They can attend sporadic shareholder meetings and try to ask a question that might encourage, at a minimum, some thought from the organization.

Beyond that, companies have become generally unresponsive in the Investor Relations department. In fact, the function seems to have become optional.

The other option of publicly questioning a company in response to social media posts, for example, not only won’t likely influence the company but will probably make them look bad in the process. And there are a few chat boards and discussion apps where you can give opinions that might be monitored by the company, but for the most part, that would be yelling into an echo chamber.

In summary, activism may have once been a choice, but right now the main choice seems to be hope.

Jeremy Ames

Jeremy Ames

Leader, Workplace Technology

AI Evaluation Aids Shareholder Decisions

That statement is true, as it is purely a sane mind’s choice to know when activism needs to be implemented. With the changing times of artificial intelligence, the evaluation of businesses has become more precise, and with a positive mindset, shareholder activists can judge and trust the assessment of a smart machine. I believe, unless it is only needed, shareholder activism should not be called for and supported by the board.

In my personal experience as the founder of a generative AI consultancy ecosystem, dealing with partners’ and stakeholders’ activism has been challenging, but knowing the power of technology to use AI for evaluation has helped me to resolve things quickly and take a decision in favor of the business expansion and spreading awareness about the role superintelligence technology will play in our lives.

Vaibhav Mittal

Vaibhav Mittal

Independent Director & Consultant, DIGITAL HUB INDIA

Transparency Builds Shareholder Trust

Transparency is the cornerstone of building trust between shareholders and the company. When leaders openly share information about the company’s performance and strategies, it instills confidence among investors. This openness allows shareholders to make informed decisions about their investments.

A commitment to transparency can ward off misunderstandings and lays the groundwork for mutual respect. Recognize the power of transparency in your organization’s shareholder relations and see how it can transform the dynamic for the better.

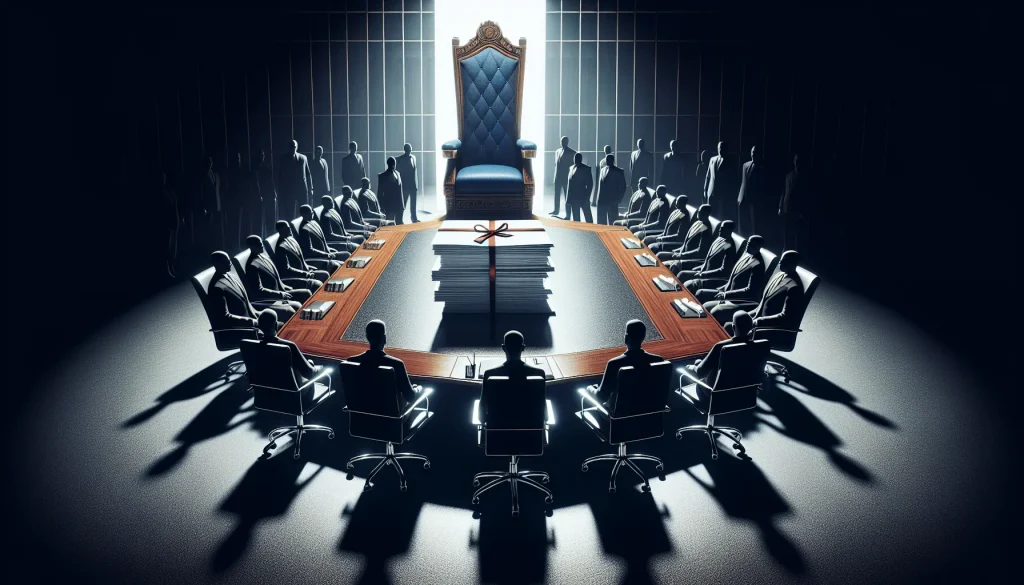

Form Alliances for Shareholder Activism

When engaging in shareholder activism, forming strategic alliances is crucial for magnification of efforts. By allying with like-minded investors, a structured approach can be forged to effectuate change within a corporation. This unified front can significantly influence the direction and decisions of a company’s management.

An effective alliance combines the strengths and resources of each member to push for meaningful and impactful change. Begin conversations with fellow investors and consider the strength in numbers to champion your activist causes.

Focus on Long-Term Shareholder Value

Focusing on long-term value is at the heart of effective shareholder engagement. Leaders aiming for sustainable growth understand the importance of considering the future implications of their decisions. This approach not only benefits the investors but also supports the company’s ability to thrive in the long run.

Ensuring that actions and strategies align with long-term value creation can result in enduring success and stability. Take a step back and evaluate your engagement strategies to ensure they’re aligned with creating lasting value.

Diverse Perspectives Enhance Governance

In any organization, bringing in a variety of perspectives can significantly enhance governance practices. When diverse voices are included in decision-making, it leads to a more comprehensive understanding of challenges and opportunities. This diversity goes beyond gender and ethnicity, encompassing different experiences, backgrounds, and skill sets.

It ensures a multitude of viewpoints are considered, promoting a balanced and well-rounded governance process. Encourage the inclusion of diverse members in your governance to cultivate more effective and holistic leadership.

Proactive Dialogue Resolves Conflicts

Proactive dialogue with shareholders is key to resolving potential points of conflict before they escalate. By engaging in conversation early, leaders can gain insights into investor concerns and address them directly. This preemptive communication can prevent misunderstandings and foster a collaborative atmosphere.

A practice of consistent and open dialogue builds a foundation for ongoing positive interaction with shareholders. Initiate regular and constructive conversations with your investors to maintain a harmonious and proactive relationship.